35+ Cost of 30 year mortgage calculator

The pass-through rate is different from the WAC. While both loan types have similar interest rate profiles the 15-year loan typically offers a lower rate to the 30-year loan.

Clarke Coole Principal Charter Mellon Linkedin

Lets assume youre buying a 250000 property at a rate of 3 and have a 30 deposit.

. Lets try another one. 30-year mortgage rates. In this scenario 50 would cost the lender more.

Cost of Living in Gatineau. Cost of Living in Belleville. Adding an extra five years brings the monthly repayment down to 738 while a 35-year mortgage would only cost 673 a month.

The most common mortgage terms are 15 years and 30 years. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. Mortgage payments which are typically made monthly contain a repayment of the principal and an interest element.

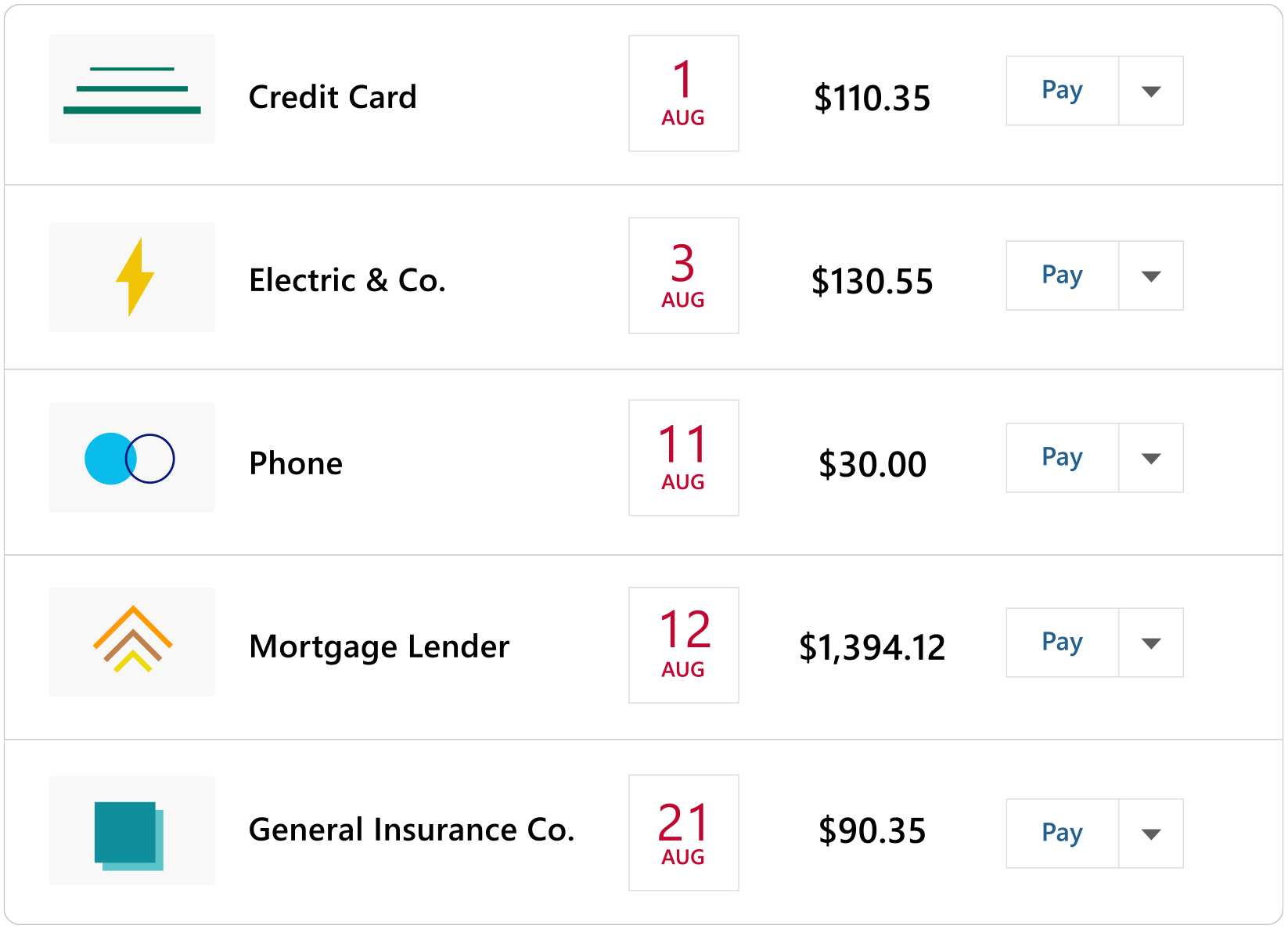

This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Youll need to also consider how the VA funding fee will add to the cost of your loan. Todays national mortgage rate trends.

Second mortgage types Lump sum. The total cost of the Social Security program for the year 2019 was 1059 trillion or about 5 percent of US. Just as this article describes a bond as a 30-year bond with 6 coupon rate this article describes a pass-through MBS as a 3 billion pass-through with 6 pass-through rate a 65 WAC and 340-month WAM.

In the example each point would cost 2000 because 1 of 200000 is equal to 2000. Cost of Living in Kingston. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Simple Mortgage Calculator. Average wire transfer fees by bank. This shortens their.

Use our calculator above. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. 30 Year Fixed Rate.

Press spacebar to show inputs. What is the differece in. The spreads change over time but the 15-year is typically about a half a percent lower than the 30-year.

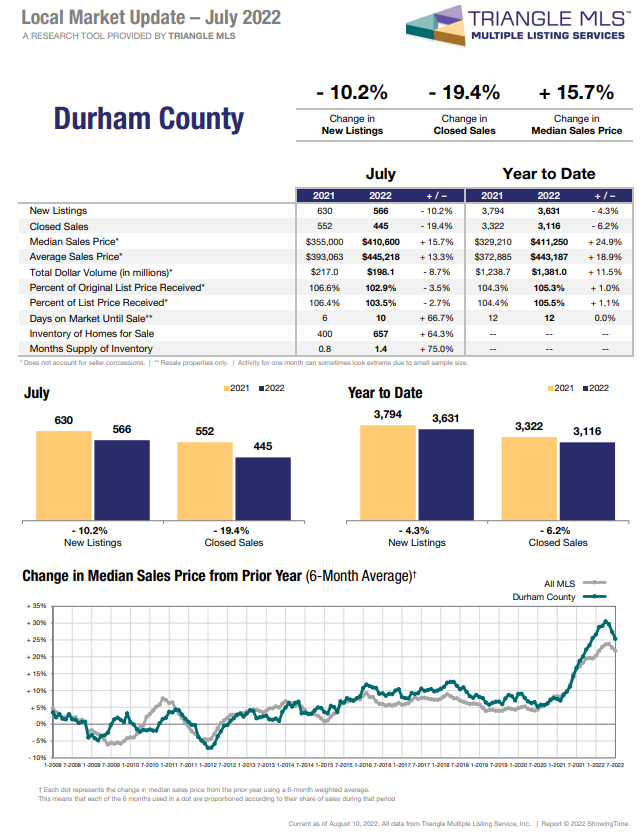

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

In the UK and US 25 to 30 years is the usual maximum term although shorter periods such as 15-year mortgage loans are common. A 30-year mortgage comes with a locked interest rate for the entire life of the loan. The Higher Value 4 Year Fixed Interest Rate is available to new and existing AIB mortgage customers including Switchers Top-ups and Self Builds with a mortgage loan of at least 250000 and a term of 4 years or more.

Getting an early start on retirement savings can make a big difference in the long run. 30 45 6000 36 54 27 41 7000 33. While international outgoing wire transfer fees are usually 35-50.

Lower interest rates compared to 30-year terms. Because the rate stays the same expect your monthly payments to be fixed for 30 years. Need a sample amortization schedule for a 30-year fixed mortgage.

Borrowing 175000 over 25 years would cost you 830 a month. Switchers availing of the Higher Value rate can also benefit from the 2000 Switcher cash offer. Second mortgages come in two main forms home equity loans and home equity lines of credit.

Thats 1104 or 1884 less each year. The subprime mortgage credit crisis of 2007-2010 however limited lender access to the capital needed to make new loans reining in growth of the private student loan marketplace The annual increase in private student loan volume was about 25 to 35 per year compared with 8 per year for federal loan volume. To estimate your break-even point more easily you can use the above calculator.

To purchase 2 points this would cost 4000. You will need to work backward by altering the mortgage cost and supplying details of your. Assuming a loan term of 30 years with an interest rate of 5 you may qualify for a home up to 74066 and have a monthly payment of 467.

The AIME is then used to calculate the Primary Insurance Amount or PIA. 20 to 30 per payment 28 for first late payment 39 for subsequent late payments CFPB. It is the rate that the investor would receive if heshe held this pass-through MBS and.

Yes its possible to get a mortgage on 20k a year. 35 years times 12 months per year produces a persons Average Indexed Monthly Earnings or AIME. Cost of Living in Ottawa.

65897 66. Bankrates mortgage calculator can help you explore how different purchase. Cost of living comparison calculator.

30 Year Fixed 15 Year Fixed 30 Year FHA 30 Year Jumbo 51 ARM 30 Year VA 30 Year Jumbo Mortgage Rates Average 30 year fixed JUMBO mortgage rates from Mortgage News Daily and MBA. Few homes are built to last 100 years. For this reason when they can afford it homeowners refinance their 30-year mortgage into a 15-year loan when index rates are lower.

The amount going toward the principal in each payment varies throughout the term of the mortgage. This is due the life of the loan unless. This calculator figures monthly mortgage payments based on the principal borrowed the length of the loan and the annual interest rate.

1317957 132 rounded to the nearest whole number 132 months to reach your break-even point on your investment. Cost of Living in Quebec City. Mortgage Amount Interest Rate Mortgage Term years.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. By saving an extra 76 per month the 25-year-old in the example above can close the 265261 shortfall projected by SmartAssets retirement calculator. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

Annual mortgage insurance premium MIP costs 085 of the loan amount per year split up into 12 installments and paid monthly with the mortgage payment. This interactive chart shows the total cost of your mortgage broken down by payment and interest. Head on over to our mortgage qualifying calculator to determine what those amounts will be with different interest rates and loan terms.

Additional Mortgage Payment Savings Infographic Househunt Real Estate Blog Mortgage Payment Savings Infographic Mortgage Info

1

35 Costly Medical Bankruptcy Statistics Etactics

1

Ex 99 2

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

35 Costly Medical Bankruptcy Statistics Etactics

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

35 Costly Medical Bankruptcy Statistics Etactics

Will Rising Interest Rates Kill Atlanta S Hot Housing Market Atlanta Ga Patch

1

Amortization Table Real Estate Exam

Kenya Silver Ceramic Wall Tile 8 X 24 In Banheiros Pequenos Modernos Banheiro Pequeno Casas

35 Bike Storage Ideas For Small Apartments Diy Bike Rack Bike Storage Solutions Bike Storage

Image 023 Jpg

Carl Johnson Real Estate Blog

Quicken Premier Software For Windows Download Quicken Today